What Is Bookkeeping and Its Purpose?

What Is Bookkeeping and Its Purpose?

Molyet Bookkeeping & Accounting LLC

Bookkeeping is the foundation of financial management for any business. Understanding its intricacies and significance is crucial for steering a company toward success. In this comprehensive guide, we will delve into the world of bookkeeping, exploring its definition and objectives, defining the role of a bookkeeper, and distinguishing bookkeeping from accounting.

Defining Bookkeeping

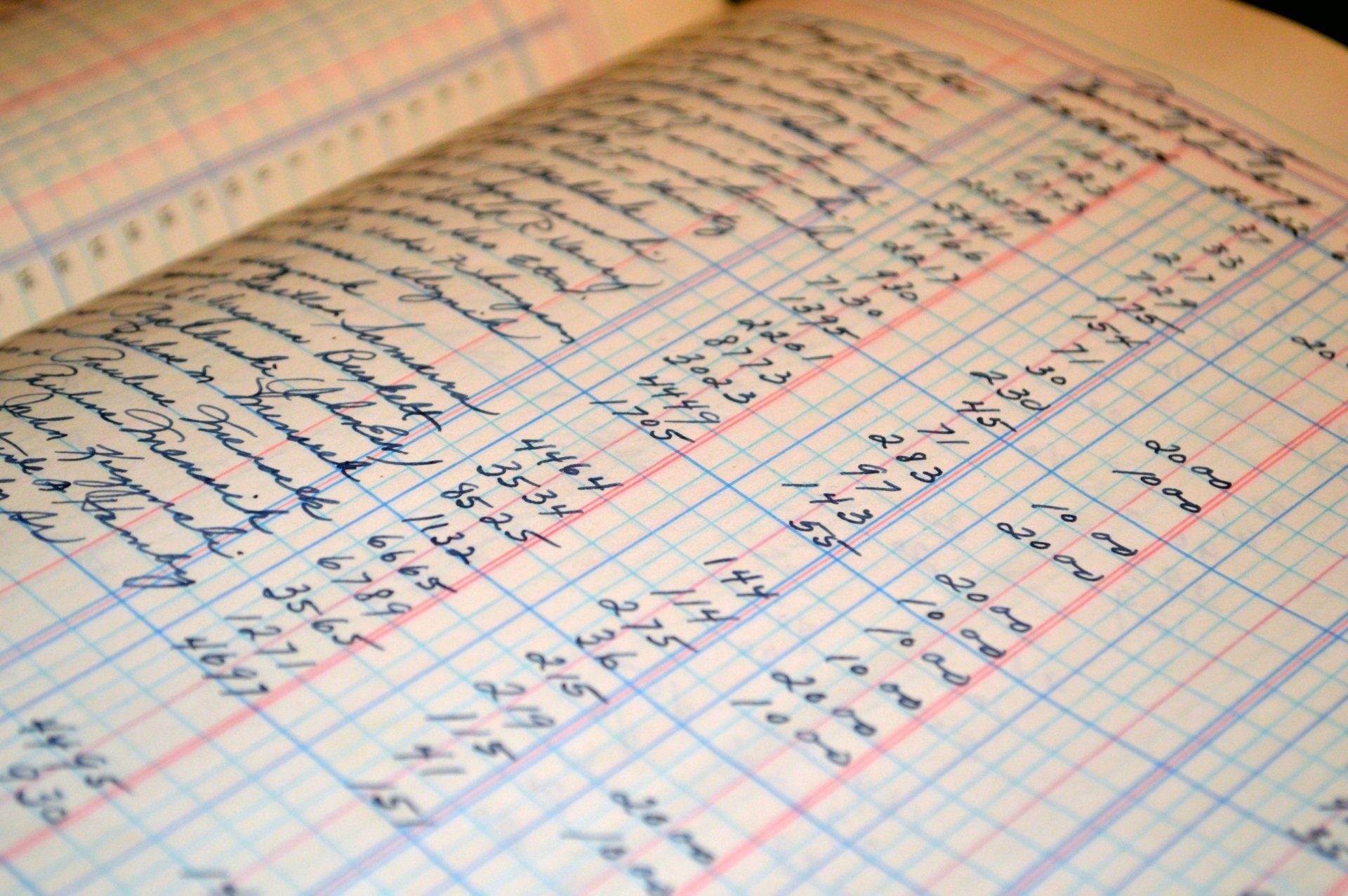

Bookkeeping is the systematic recording, organizing, and maintenance of financial transactions within a business. It involves meticulously documenting income, expenses, assets, liabilities, and equity. Essentially, it is the process of keeping track of all the financial activities that occur within an organization.

The Objectives of Bookkeeping

The primary objectives of bookkeeping include the following.

Accurate Financial Records

The fundamental goal of bookkeeping is to maintain precise and comprehensive financial records. This process involves recording every financial transaction with meticulous detail. Accuracy ensures that the financial statements present a true and fair view of the company’s financial position.

Financial Transparency and Clarity

Bookkeeping fosters transparency by organizing financial data in a manner that’s easily accessible and understandable. Clear records enable stakeholders, including business owners, investors, and regulators, to comprehend the financial health of the business, fostering trust and credibility.

Informed Decision-Making

One of the primary purposes of bookkeeping is to equip decision-makers with reliable financial information. Accurate records serve as a basis for analyzing trends, identifying areas of strength or weakness, and making informed strategic decisions that drive the business forward.

Compliance and Legal Requirements

Bookkeeping ensures adherence to regulatory and legal requirements. By maintaining accurate financial records, businesses can fulfill tax obligations, follow accounting standards, and comply with government regulations. These steps help in avoiding penalties and legal complications.

Facilitating Financial Analysis

Well-organized financial records serve as a foundation for in-depth financial analysis. Bookkeeping provides the data needed for various financial assessments, such as cash flow analysis, profitability ratios, and performance comparisons. These analyses aid in understanding the business’s financial health and identifying areas for improvement.

What Does a Bookkeeper Do?

A bookkeeper is responsible for executing the day-to-day tasks related to bookkeeping. Their duties include recording financial transactions, reconciling accounts, generating financial reports, managing payroll, and maintaining a general ledger. They play a critical role in ensuring that financial records are accurate, up-to-date, and compliant with relevant standards.

Bookkeepers utilize various tools and software to streamline the bookkeeping process. These tools not only enhance efficiency but also reduce the chances of errors in calculations or data entry.

Bookkeeping vs. Accounting: What’s the Difference?

While bookkeeping and accounting are often used interchangeably, they serve distinct purposes within the financial landscape.

Bookkeeping is the meticulous recording and organization of day-to-day financial transactions. It involves maintaining accurate records, categorizing entries, and managing financial data.

- Function: Recording transactions systematically

- Focus: Recording and organizing financial data

- Responsibility: Maintaining ledgers and reconciling accounts

Meanwhile, accountants interpret and analyze the data that bookkeepers record. It involves interpreting financial data, generating reports, and offering insights for decision-making.

- Function: Analyzing and interpreting financial data

- Focus: Analyzing data for insights

- Responsibility: Providing financial analysis, reporting, and strategic planning

Both are integral to a comprehensive financial management system, with bookkeeping forming the foundation upon which accounting builds for informed decision-making and planning.

Final Words on Bookkeeping

Bookkeeping is a sound financial management system for businesses. Meticulous recording and organization of financial data provide the necessary foundation for accurate reporting and informed decision-making. By understanding the nuances between bookkeeping and accounting, business owners can appreciate the complementary roles they play in maintaining financial health.

Ready to transform your small business’s approach to tax season?

Contact Molyet Bookkeeping & Accounting LLC to unlock the full potential of professional small business accounting services.