Bookkeeping Strategies to Enhance Your Business's Financial Health

Bookkeeping Strategies to Enhance Your Business's Financial Health

Molyet Bookkeeping & Accounting LLC

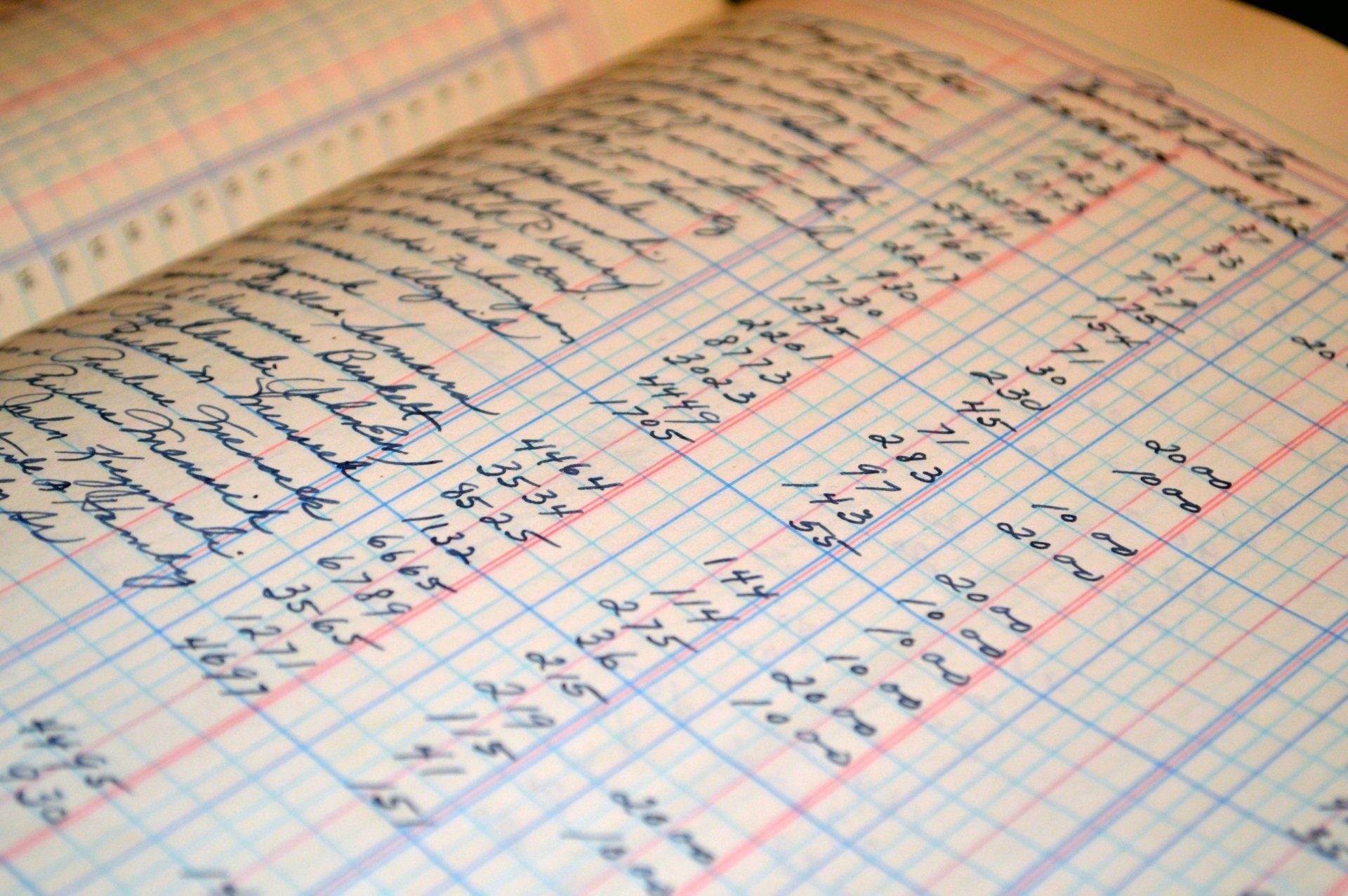

Effective bookkeeping is not just about keeping track of numbers; it's a strategic tool that can significantly influence your business's financial health and overall success. At Molyet Bookkeeping & Accounting LLC, we understand that robust financial management is crucial for any business, large or small.

Here, we explore practical bookkeeping strategies that can strengthen your financial foundation and promote sustainable growth.

1. Regular Financial Review and Reconciliation

One of the foundational steps to maintaining healthy business finances is the regular review and reconciliation of accounts. This means systematically checking that your records match bank statements and financial transactions, ensuring accuracy and consistency. Regular reconciliations help prevent errors, fraud, and mismanagement of funds. It allows you to catch discrepancies early and maintain precise control over your financials, which is crucial for making informed business decisions.

2. Effective Cash Flow Management

Cash flow is the heartbeat of your business. Managing it effectively involves not just monitoring the money flowing in and out but also planning for future financial needs. Effective bookkeeping strategies for managing cash flow include:

· Forecasting: Use historical data to predict future financial conditions and cash needs. This helps in understanding seasonal impacts on your business and planning for growth or downturns effectively.

· Invoicing Practices: Streamline invoicing to ensure prompt payments. Implement policies such as sending invoices immediately upon delivery of goods or completion of services, and setting clear terms for early payments or penalties for late payments.

· Expense Tracking: Keep a vigilant eye on expenditures. Categorize expenses to identify areas where cost reductions can be made without impacting business operations.

3. Utilizing Technology

Leveraging modern bookkeeping software and technology is another strategic approach to enhancing your financial health. Today’s bookkeeping technologies offer automation of routine tasks, real-time data processing, and advanced analytics capabilities. These tools can improve accuracy and provide deeper insights into your business’s financial status. Technologies like cloud-based bookkeeping software allow for easy access to financial data from anywhere, facilitating better collaboration and decision-making.

4. Compliance and Tax Planning

Staying compliant with tax laws and regulations is crucial for any business. A professional bookkeeper ensures that your business adheres to these laws, helping to avoid costly penalties and legal issues. Effective tax planning involves:

· Maximizing Deductions: Identify all possible tax deductions and credits that your business is eligible for, ensuring you do not pay more tax than necessary.

· Timely Filing: Ensure all financial obligations are met before deadlines. This not only avoids penalties but also enhances your business's credibility and trustworthiness.

5. Debt Management

Effective management of debt is crucial for maintaining a healthy balance sheet. Bookkeeping can help manage debts by:

· Tracking Due Dates: Keeping a record of when payments are due helps avoid late fees and interest charges.

· Evaluating Loan Terms: Regularly assess the terms of existing debts and consider refinancing options if more favorable terms are available.

· Prioritizing Repayments: Use your bookkeeping data to strategize which debts to pay off first based on interest rates and terms.

6. Strategic Business Planning

Finally, your bookkeeper can contribute to strategic planning by providing accurate and detailed financial reports. These reports are crucial for:

· Budgeting: Developing and adjusting your business budget based on accurate financial data.

· Investment Decisions: Identifying surplus cash that can be safely invested in business growth opportunities.

· Performance Evaluation: Comparing projected financial outcomes with actual results to assess the effectiveness of business strategies.

Setting the Stage for Financial Success

Implementing these bookkeeping strategies can significantly enhance your business’s financial health. At Molyet Bookkeeping & Accounting LLC, we provide the expertise and tools necessary to implement these strategies effectively, helping your business thrive in a competitive environment. For more insights and to learn how we can assist you further, visit our website.

By taking a strategic approach to bookkeeping, you ensure your business is not just surviving but is set up for long-term financial success.