A Guide to Small Business Accounting Services and Tax Compliance

A Guide to Small Business Accounting Services and Tax Compliance

Molyet Bookkeeping & Accounting LLC

Tax season can be daunting for small business owners, but with the right strategies, it doesn’t have to be a source of stress. While some small business owners attempt to manage their taxes independently, partnering with small business accounting services can make a substantial difference. Accounting experts possess a deep understanding of tax codes, regulations, and potential changes, providing invaluable guidance.

In this guide, we delve into the pivotal role of professional small business accounting services in ensuring smooth tax compliance. From bookkeeping practices to maximizing deductions and credits, we provide actionable insights that empower small business owners to confidently navigate tax season.

Record-Keeping

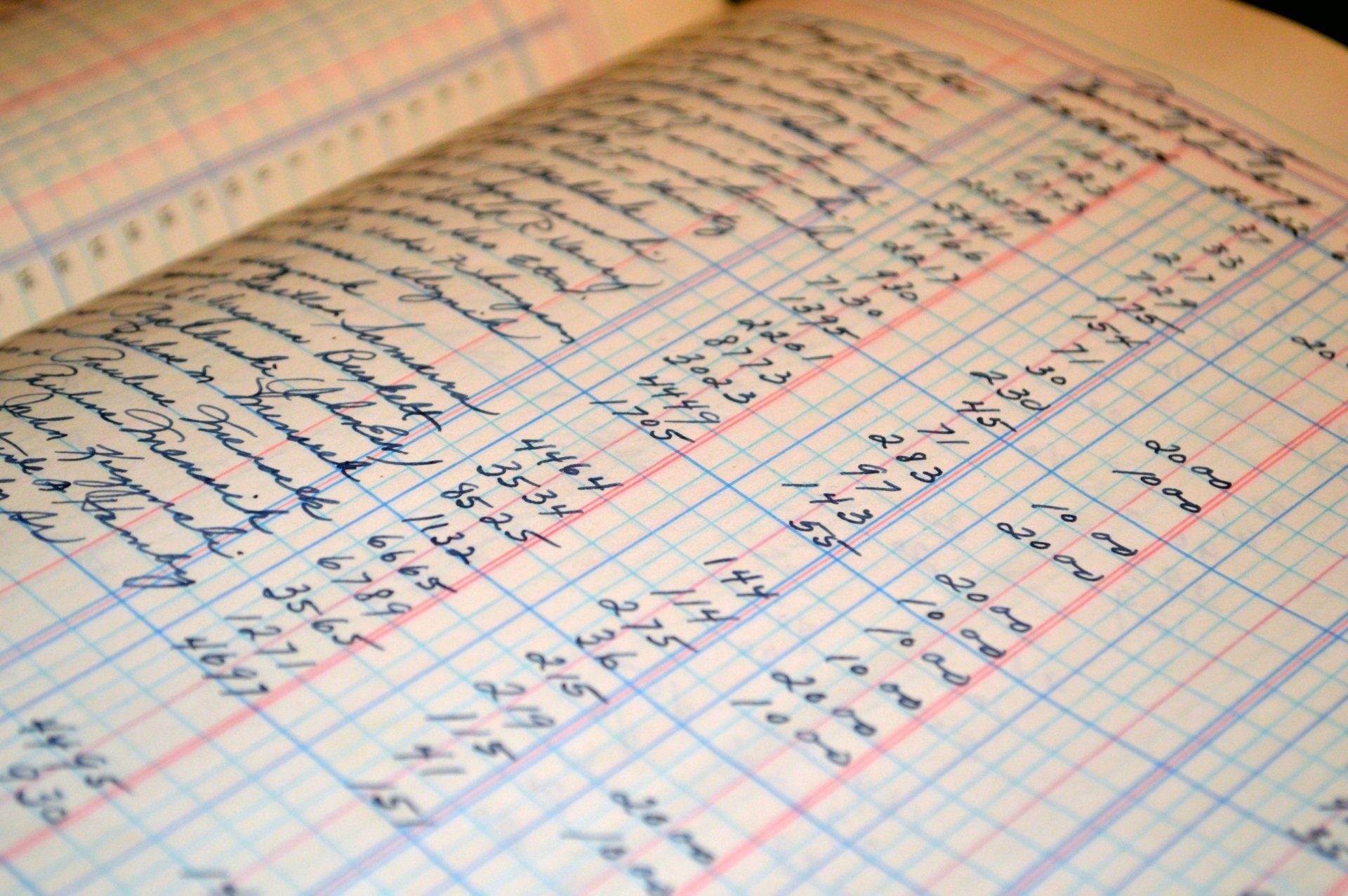

Accurate and organized record-keeping is the bedrock of successful small business tax compliance. Maintaining meticulous records throughout the year ensures that all financial transactions are properly documented and categorized. Cloud-based accounting software can be a game-changer, allowing for real-time tracking of income and expenses. This not only streamlines the tax preparation process but also minimizes the risk of errors.

Get Bookkeeping Done Early

One of the cardinal rules for small business tax compliance is to avoid the last-minute scramble. Waiting until the eleventh hour to address bookkeeping tasks can lead to unnecessary stress and potential errors. Early bookkeeping facilitates a smoother tax season and offers several advantages for small businesses. Getting a head start on bookkeeping allows small business owners to maintain a clear and up-to-date financial picture throughout the year. Regularly reconciling accounts, categorizing transactions, and ensuring all necessary documentation is in order significantly reduces the work when tax season arrives.

Maximizing Tax Benefits through Deductions and Credits

Small business owners often overlook eligible deductions and credits that could significantly reduce their tax liability. A knowledgeable accounting professional can help identify potential deductions related to business expenses, home office use, equipment purchases, and more. By understanding the intricacies of tax law, these professionals can guide businesses in taking advantage of every opportunity to minimize their tax burden.

Planning for the Future

Beyond immediate tax compliance, accounting services can assist small businesses in long-term financial planning. By analyzing historical financial data and projecting future trends, accountants can help companies make informed decisions that align with their goals while optimizing tax outcomes. This forward-thinking approach transforms accounting services into a strategic asset for small businesses.

Staying Informed on Tax Law Changes

Tax laws are constantly evolving, and staying informed is vital for small business owners. Small business accounting professionals keep abreast of legislative changes that may impact tax obligations. Regular consultations with accountants ensure that businesses are aware of new deductions, credits, or compliance requirements, providing a proactive approach to tax planning and minimizing potential risks.

Unlock Tax Season Success: Partner with Molyet Bookkeeping & Accounting for Expert Small Business Solutions

Small businesses can confidently navigate tax season by leveraging small business accounting services. From meticulous record-keeping to maximizing deductions and credits, these services are pivotal in ensuring compliance and optimizing tax returns. Collaborating with accounting professionals fosters a proactive approach to financial management, providing small business owners with the tools and insights needed to not only survive tax season but thrive in the ever-changing business landscape.

Ready to transform your small business’s approach to tax season? Contact Molyet Bookkeeping & Accounting to unlock the full potential of professional small business accounting services.