Year-End Bookkeeping Checklist: Preparing for a Smooth Transition into the New Year

Year-End Bookkeeping Checklist: Preparing for a Smooth Transition into the New Year

Molyet Bookkeeping & Accounting LLC

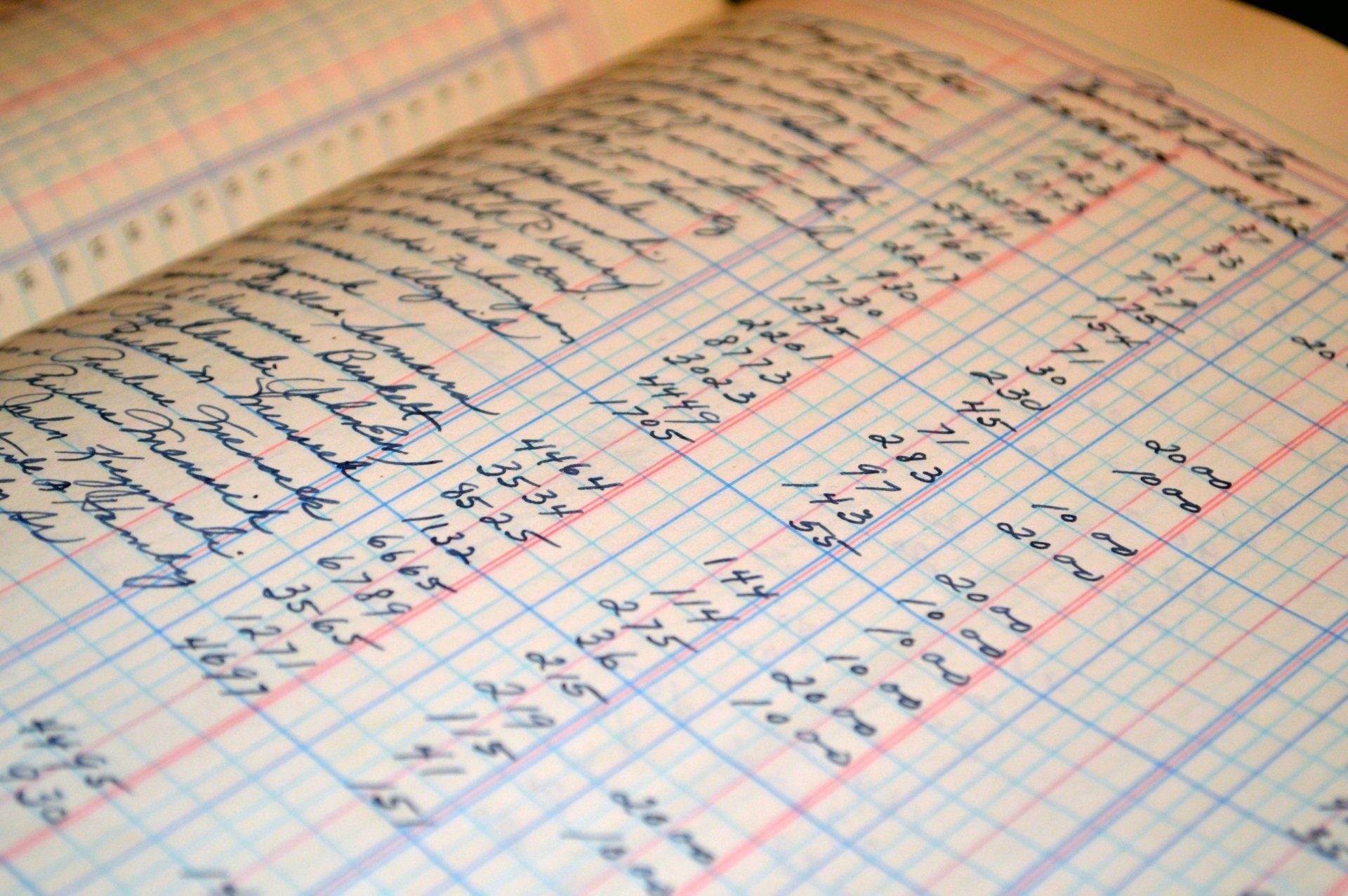

As the year draws to a close, businesses must tackle the essential task of wrapping up their financials. Proper year-end bookkeeping is not just about compliance—it’s about setting your business up for success in the coming year. Here’s a comprehensive checklist to guide you through the critical financial tasks that should be on every business’s radar as the New Year approaches.

1. Reconcile All Bank and Credit Card Accounts

Ensure that your bank and credit card statements match your internal records. Reconciling these accounts helps catch any discrepancies, such as double charges or unrecorded transactions, and provides a reliable foundation for accurate financial reporting.

2. Review Accounts Receivable

Collecting outstanding invoices is crucial as the year ends. Review your accounts receivable to identify any past due accounts and make efforts to collect them. This process not only bolsters your cash flow but also cleans up your books, making it easier to start the New Year afresh.

3. Conduct an Inventory Count

If your business holds inventory, conduct a year-end count to verify record accuracy. This task is vital for assessing the cost of goods sold and understanding product performance, which in turn informs your purchasing and sales strategies for the New Year.

4. Review Fixed Assets and Depreciation

Evaluate your fixed assets and ensure proper accounting for purchases, sales, and depreciation over the year. This review affects both your tax strategy and your company’s financial health, as it impacts your balance sheet and future capital expenditure planning.

5. Finalize Financial Statements

Prepare your income statement, balance sheet, and cash flow statement. These documents provide a clear view of your business’s financial health and are essential for making informed business decisions, securing loans, and attracting investors.

6. Assess and Record Prepaid Expenses and Accruals

Adjust entries for expenses paid in advance and revenues that are earned but not yet received. This step is crucial for accurate financial reporting under the accrual basis of accounting.

7. Prepare for Tax Time

Gather and organize all necessary documentation needed for tax filing, including receipts, bank statements, invoices, and payroll records. Consider scheduling a consultation with your accountant to discuss tax strategies, potential deductions, and new tax laws that could impact your business.

8. Set Budgets and Financial Goals for the New Year

Reflect on the past year’s financial performance and use this insight to set budgets and financial goals for the upcoming year. This planning includes forecasting revenue, expenses, and cash flow needs.

9. Review Your Bookkeeping Practices

Year-end is an excellent time to evaluate the effectiveness of your current bookkeeping practices. Consider whether upgrading your software, automating more processes, or hiring a professional bookkeeper could improve efficiency and accuracy.

Laying the Groundwork for Future Success

Completing these year-end bookkeeping tasks will not only help you close out the current year without loose ends but also position your business for a prosperous and organized start to the New Year. By ensuring all financial elements are in order before the clock strikes midnight, you set the stage for financial success and easier management in the months to come.

Implementing these bookkeeping strategies can significantly enhance your business’s financial health. At Molyet Bookkeeping & Accounting LLC, we provide the expertise and tools necessary to implement these strategies effectively, helping your business thrive in a competitive environment. For more insights and to learn how we can assist you further, visit our website.

By taking a strategic approach to bookkeeping, you ensure your business is not just surviving but is set up for long-term financial success.