What Are the Most Common Tax Filing Errors?

What Are the Most Common Tax Filing Errors?

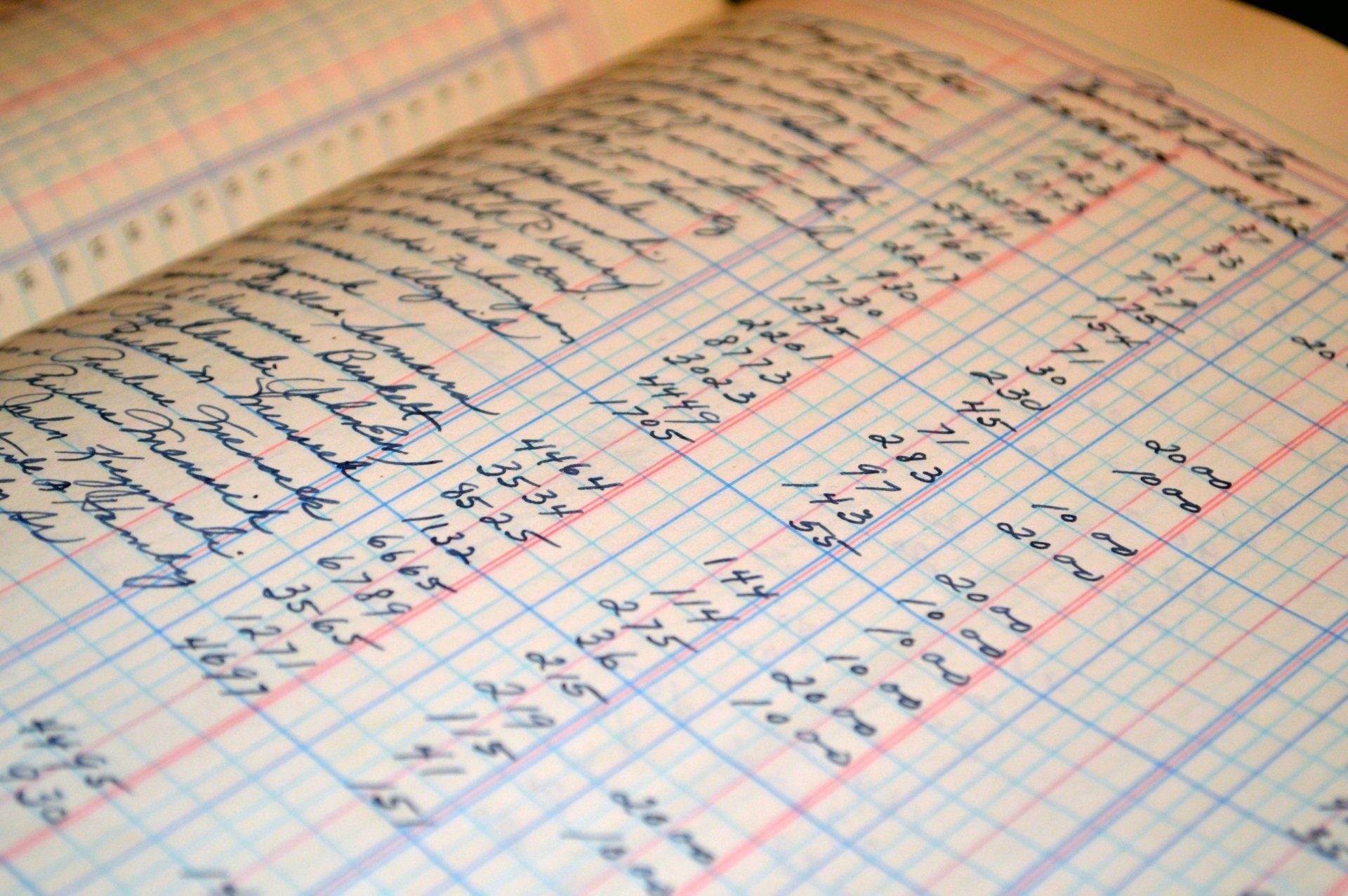

Molyet Bookkeeping & Accounting LLC

Tax season can feel like navigating a labyrinth, with potential pitfalls at every turn. At Molyet Bookkeeping & Accounting LLC, we understand the intricacies of tax filing and the importance of steering clear of common errors that can derail your financial plans.

Here, we dive into the most prevalent tax filing mistakes and equip you with strategies to sidestep these pitfalls. From computational blunders to overlooking crucial details, each misstep can impact your tax liabilities and financial well-being.

Moreover, we’ll offer insights into how you can rectify these errors should they occur, ensuring a smoother path forward. We aim to empower individuals and businesses to protect themselves against errors.

Incorrect Computations

Fuzzy math can lead to significant discrepancies in your tax filings. Whether it’s a simple addition error or a complex calculation misstep, these mistakes can cause underpayment or overpayment, triggering unwanted attention from the IRS.

- Use reliable tools: Leverage trusted tax software or consult a professional to ensure accuracy in your calculations.

- Review thoroughly: Double-check every figure meticulously before submission to mitigate computational errors.

Incorrect Filing Status

Choosing the wrong filing status can have a domino effect on your tax liabilities and benefits. The IRS offers multiple filing statuses, and selecting the most fitting one is crucial for an accurate reflection of your circumstances.

- Understand guidelines: Familiarize yourself with the IRS guidelines for each filing status to make an informed decision.

- Seek expert advice: When in doubt, consult with a tax professional for guidance on the most appropriate filing status for your situation.

Omitting Your Actual Income

Failure to report all income sources can raise red flags with the IRS. This includes various forms of earnings, such as wages, freelance income, investments, and other financial gains.

- Maintain detailed records: Keep meticulous records of all sources of income throughout the year to ensure nothing gets overlooked.

- Cross-check documents: Compare forms like W-2s, 1099s, and other income statements against your records to confirm accuracy.

Outdated Information

Tax laws are dynamic and subject to change. Relying on outdated forms or regulations might result in errors in your filing and potential penalties.

- Stay informed: Regularly update yourself with the latest IRS guidelines and forms to ensure compliance with current regulations.

- Utilize trusted sources: Refer to official IRS publications or consult with professionals to access accurate and updated information.

Including Standard Deductions

Opting for standard deductions without considering itemizing might mean missing out on potential tax savings.

- Evaluate deductions: Assess whether itemizing deductions would yield greater tax benefits compared to the standard deduction for your situation.

- Consult for optimization: Seek advice from tax experts to determine the most advantageous deduction strategy for your circumstances.

Not Taking Write-Offs

Neglecting eligible deductions or credits can mean leaving money on the table. Being unaware of available deductions could lead to overpayment of taxes.

- Research deductions: Explore all possible deductions and credits applicable to your specific situation to maximize your tax savings.

- Seek expert guidance: Consult with tax professionals to ensure you’re capitalizing on every eligible deduction or credit.

Ensure Seamless and Accurate Accounting with Dedicated Services

Ensuring accurate tax filings involves attention to detail and staying informed about tax laws. However, mistakes can happen. Being vigilant and proactive in identifying and correcting these errors can help prevent unwanted consequences with the IRS.

At Molyet Bookkeeping & Accounting LLC, we prioritize accuracy in tax filings. Our personalized accounting services cater to your individual or business needs, ensuring timely and precise tax returns, sales tax filings, and meticulous bookkeeping. Trust us to navigate the complexities of tax preparation while keeping your interests at the forefront.