What To Do If You Make Errors on Your Taxes

What To Do If You Make Errors on Your Taxes

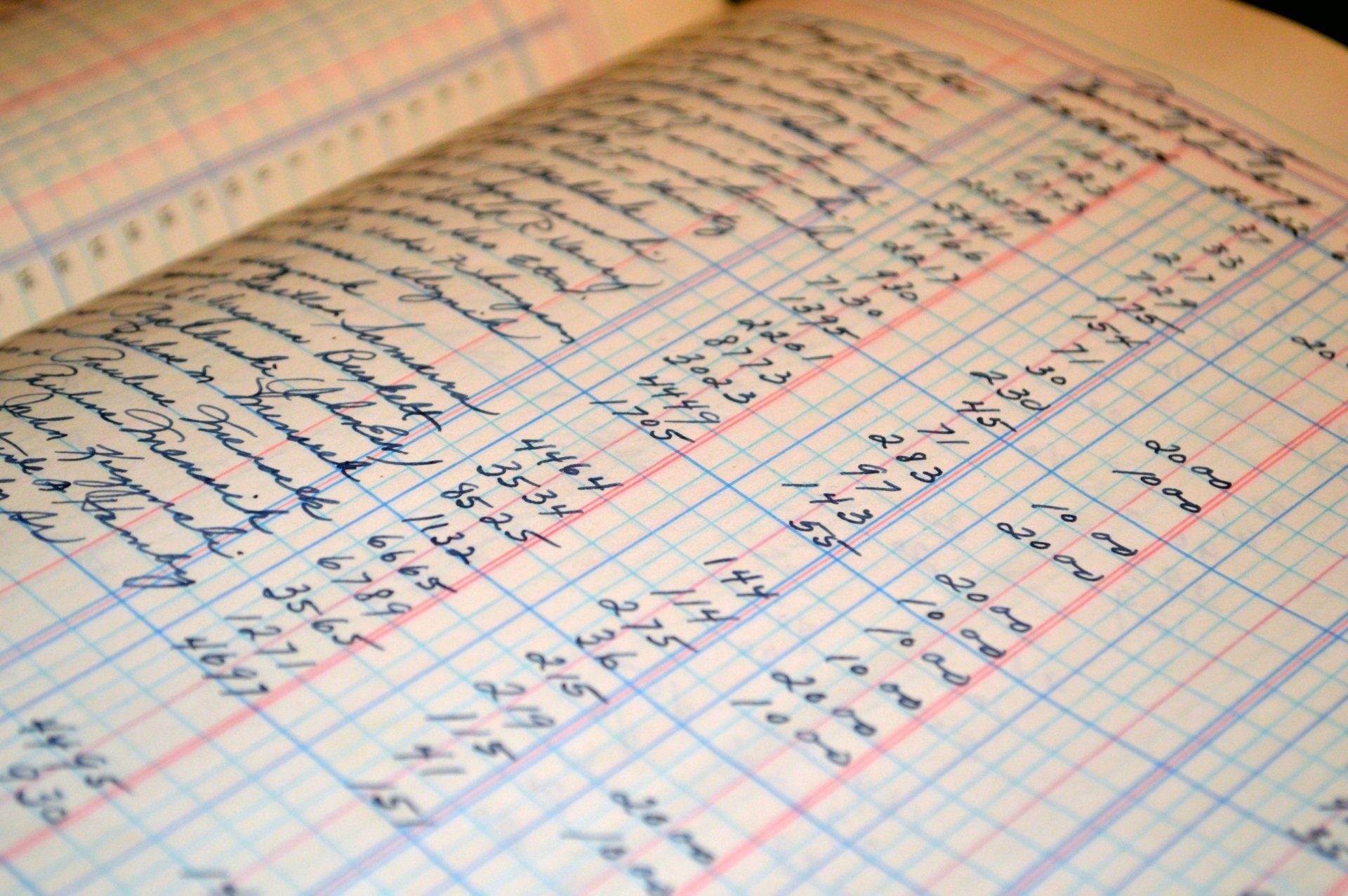

Molyet Bookkeeping & Accounting LLC

Tax season can be stressful for many Americans, and unfortunately, tax filing errors are all too common. From simple miscalculations to forgetting crucial deductions, mistakes on tax returns can lead to financial headaches.

Here, we touch on some of the most common tax filing errors, explore what you should do if you catch an error in your tax information, and discuss ways to prevent these mistakes in the future.

The Most Common Tax Filing Errors

Recognizing the most common mistakes helps you stay vigilant in tax preparation:

- Mathematical errors: Simple math mistakes are surprisingly common when filling out tax forms. From addition and subtraction errors to miscalculating percentages, these mistakes can lead to discrepancies in your final tax liability.

- Incorrect information: Providing inaccurate personal information, such as Social Security numbers or misspelling names, can cause significant problems. Double-check all personal details to ensure accuracy.

- Forgetting deductions: Many taxpayers miss out on potential deductions simply because they are unaware of the available options. Common deductions include education expenses, medical costs, and charitable contributions.

- Filing status errors: Choosing the wrong filing status can result in incorrect tax calculations. Ensure you understand the implications of each filing status and select the one that best suits your situation.

What You Need To Do When You Catch an Error

Discovering an error on your tax return can be a stressful experience, but knowing how to respond and rectify the situation is crucial to mitigating potential consequences.

Stay Calm

Discovering an error on your tax return can be anxiety-inducing, but staying calm is crucial. Panicking can lead to hasty decisions that could exacerbate the situation.

The IRS Could Correct Simple Errors

In some cases, the IRS may catch and correct minor mistakes while processing your return. However, relying solely on this possibility is not advisable, and you should take proactive steps to address any errors.

See If You Need To File an Amended Return

If you identify a significant error, consider filing an amended return. Use Form 1040X to correct mistakes and provide a detailed explanation of the changes. Be aware that amended returns may take longer to process.

Expect a Penalty

Depending on the nature and severity of the error, you may face fines or interest charges. Understanding the potential consequences is essential for financial planning.

Talk to a Professional

If you’re unsure how to proceed or if the error is complex, it’s wise to consult with a tax professional. Certified tax experts can provide guidance on the best course of action and help you navigate the process of correcting errors.

How to Prevent Tax Errors

Preventing tax errors is a proactive approach that involves careful preparation and attention to detail. Here are steps to minimize the likelihood of mistakes on your tax return:

- Double-check your work: Review all information before submitting your tax return. Double-check calculations and personal details, and ensure you haven’t missed any deductions.

- Use tax software: Utilizing reputable tax software can significantly reduce the likelihood of errors as these programs often have built-in checks and prompts to catch common mistakes.

- Keep detailed records: Maintain organized and detailed records throughout the year, including receipts, W-2s, 1099s, and any other relevant documents. Having a systematic approach to record-keeping can streamline the tax filing process.

- Stay informed: Tax laws can change, and staying informed about these changes is crucial. Regularly update yourself on tax regulations and seek professional advice if needed.

In the complex landscape of tax filing, errors can happen to anyone— but the key is to address them calmly and promptly. If you need expert assistance, consider contacting professionals like Molyet Bookkeeping & Accounting LLC. Our expertise can guide you through the process of correcting errors and offer valuable insights into preventing future mistakes.

Remember, a proactive approach to tax preparation can save you time and money in the long run.