Unlocking Financial Success: Essential Metrics, Improved Health, and Dispelling Myths in Bookkeeping

Unlocking Financial Success: Essential Metrics, Improved Health, and Dispelling Myths in Bookkeeping

Molyet Bookkeeping & Accounting LLC

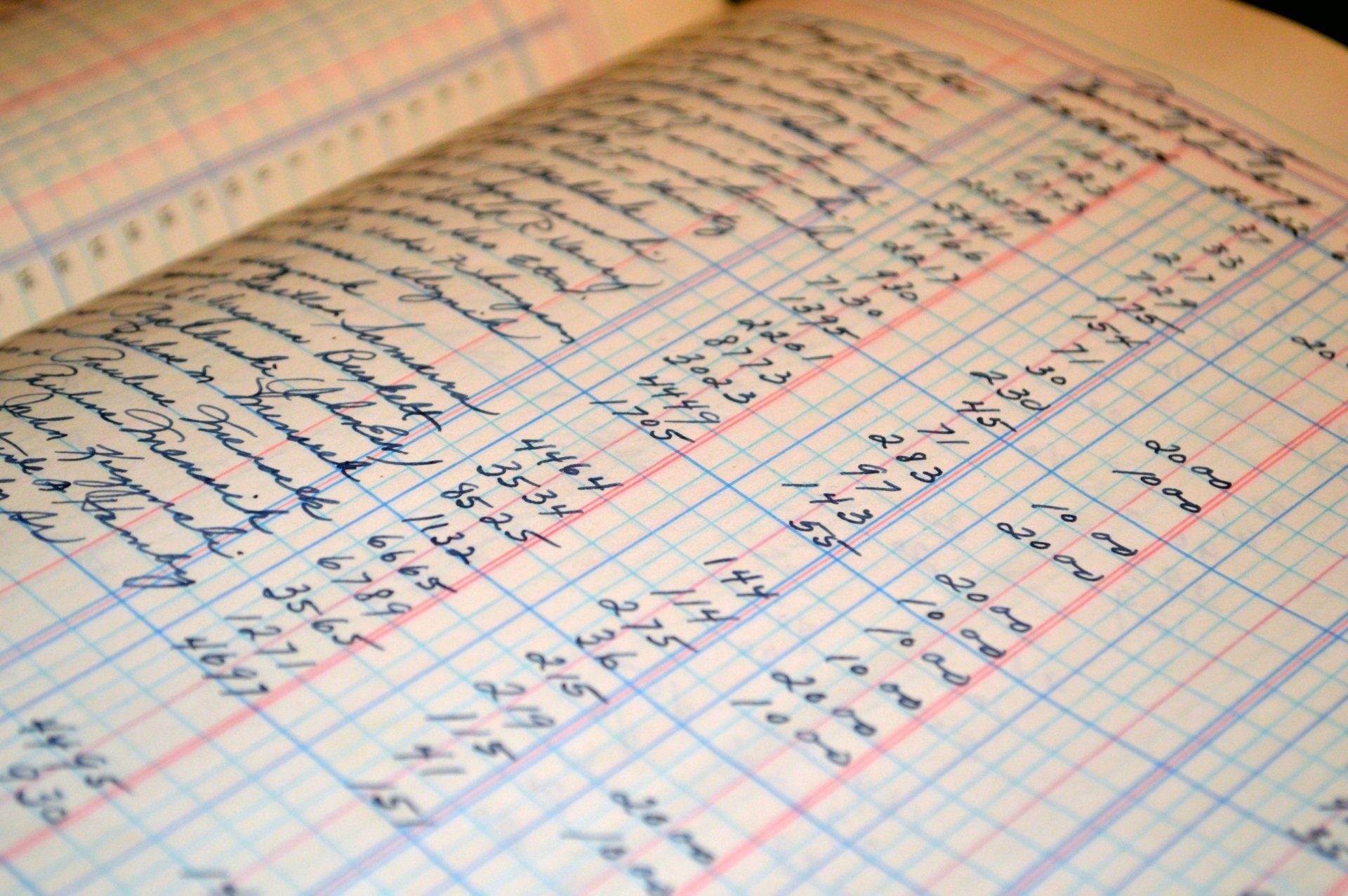

In the dynamic world of small business, the path to financial success is often paved with precise and proactive bookkeeping. Understanding and implementing effective financial management can be a game-changer for any business owner.

This comprehensive blog post dives into the essential financial metrics you should monitor, explores strategies to improve your business's financial health, and debunks common bookkeeping myths, helping you make informed decisions that propel your business forward.

Key Financial Metrics for Business Success

Every successful business venture is backed by solid financial management. Knowing which metrics to focus on can provide insights into your company's performance and what steps you need to take to improve.

Here are some crucial financial metrics that Molyet Bookkeeping can help you track effectively:

· Cash Flow: It's vital to monitor the cash flowing in and out to ensure that your business can cover its expenses and plan for future investments. Understanding Cash Flow Management offers deeper insights.

· Profit Margins: Regularly tracking your gross and net profit margins helps assess the profitability of your products or services, guiding pricing strategies and cost control.

· Accounts Receivable Aging: This metric highlights the status of outstanding customer payments and helps identify potential issues in collection processes.

With professional bookkeeping services, you not only track these metrics accurately but also gain the ability to forecast and plan based on reliable financial data.

Enhancing Your Business's Financial Health

Improving your business's financial health doesn't happen overnight. It requires strategic planning and continuous monitoring, areas where professional bookkeeping shines.

Here are a few strategies to bolster your financial health:

· Strategic Expense Management: By reviewing your financial data, a bookkeeper can identify areas where you can cut costs without compromising service quality. For more tips, see our guide on Effective Cost Management.

· Debt Management: Effective management of liabilities ensures that debt does not hinder your business's growth. A bookkeeper can help structure debt repayments in a way that keeps your cash flow healthy.

· Tax Optimization: Proper bookkeeping ensures that you take advantage of all applicable tax deductions, reducing your overall tax burden legally and efficiently.

These strategies, implemented with the help of a skilled bookkeeper, lay a robust foundation for your business’s financial wellbeing, steering you towards sustained growth and stability.

Debunking Common Bookkeeping Myths

There are several myths surrounding bookkeeping that can deter business owners from seeking professional help. Here are a few myths debunked to clarify the real value of professional bookkeeping:

· Bookkeeping is just about record-keeping. While maintaining records is a fundamental aspect, professional bookkeeping is much more. It involves strategic analysis, financial forecasting, and compliance management, all essential for informed decision-making.

· Small businesses don't need a bookkeeper. No matter the size, every business can benefit from accurate bookkeeping. It prevents costly errors, saves money on taxes, and provides a clear picture of financial health.

· Bookkeeping doesn't affect business growth. On the contrary, effective bookkeeping provides the data needed to make strategic decisions that drive growth. It helps identify profitable opportunities and areas for improvement.

Understanding these truths helps in appreciating the strategic role bookkeepers play in a business's success, encouraging more informed and productive financial management.

Charting Your Path to Financial Mastery

Effective financial management is essential for any business aiming for longevity and success. By understanding key financial metrics, employing strategies to improve financial health, and dispelling common bookkeeping myths, you can ensure your business operates on a solid financial foundation.

Molyet Bookkeeping & Accounting LLC is here to guide you through every step of this journey, making sure that your financial operations help you achieve your business goals. Explore our accounting services and let us help you unlock the full potential of your business finances.

For more insights and to learn how we can assist you further, visit our website.