The Role of a Bookkeeper in Managing Cash Flow

The Role of a Bookkeeper in Managing Cash Flow

Molyet Bookkeeping & Accounting LLC

Cash flow is the lifeblood of any business. It reflects the amount of money flowing in and out of a business, determining its financial health and operational viability. While sales and profits are crucial, having an efficient cash flow management strategy is equally important to ensure that a business remains solvent and competitive. This is where the expertise of a professional bookkeeper becomes invaluable.

Understanding Cash Flow Management

Cash flow management involves monitoring, analyzing, and optimizing the net amount of cash receipts minus cash expenses. Effective management ensures that a business has enough cash to pay its bills while also having a buffer for unexpected expenses. The role of a professional bookkeeper in this process cannot be overstated, as they are instrumental in ensuring that every financial transaction is accurately recorded and reconciled.

Accurate Financial Tracking

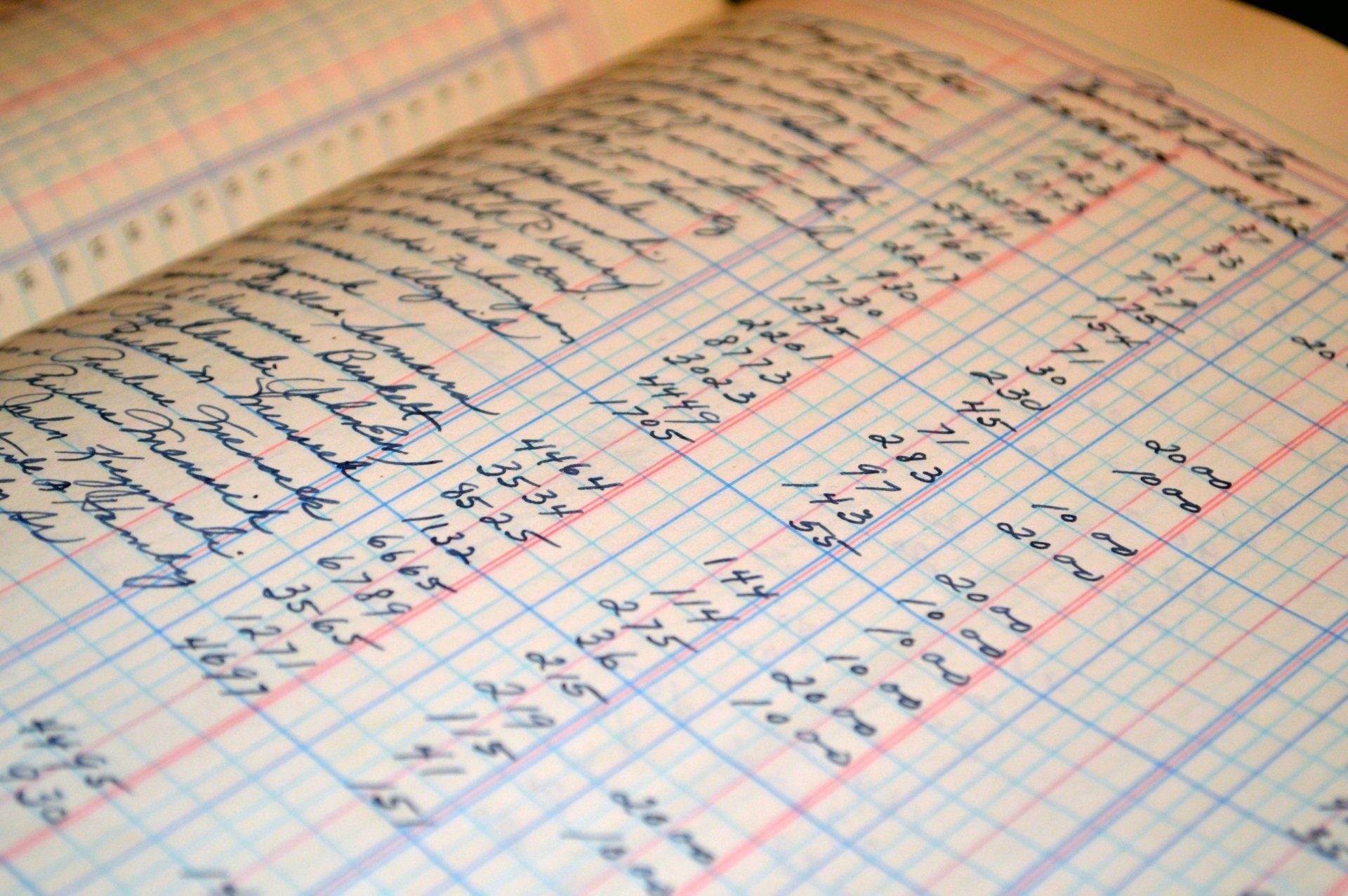

The foundational role of a bookkeeper is to keep meticulous records of all financial transactions. This includes sales, purchases, payments, and receipts. Accurate bookkeeping ensures that you have a real-time snapshot of your financial status at any given moment. With precise records, a bookkeeper can provide detailed cash flow statements that help business owners understand where their money is coming from and where it is going. This clarity is crucial for making informed financial decisions.

Forecasting and Planning

A professional bookkeeper does more than just record transactions; they also play a key role in financial forecasting and planning. By analyzing historical data, a bookkeeper can predict future cash flows, helping businesses prepare for periods of cash surplus or shortage. This proactive approach allows businesses to plan significant expenses, manage debt, and invest in growth opportunities without jeopardizing their financial stability.

Optimizing Payment Terms and Receivables

One of the critical aspects of managing cash flow is optimizing the timing of accounts receivable and payable. A skilled bookkeeper helps streamline invoicing processes to ensure that receivables are collected promptly. They can also manage payment terms to suppliers to optimize cash outflows. For instance, they might negotiate longer payment terms with suppliers during slower business periods, ensuring that the business can maintain its cash reserves.

Identifying Cost Savings and Financial Leakages

Bookkeepers are adept at scrutinizing financial records for any inconsistencies or unnecessary expenditures. By regularly reviewing the books, they can identify areas where costs can be cut or where leakages are occurring. This might involve suggesting more cost-effective suppliers, reducing overhead costs, or eliminating wasteful practices. Maintaining a lean operation not only improves cash flow but also enhances overall profitability.

Compliance and Risk Management

Compliance with regulatory requirements is another area where bookkeepers provide critical support. From tax obligations to reporting standards, ensuring compliance can prevent costly legal and financial penalties. Moreover, by maintaining accurate and up-to-date financial records, bookkeepers help minimize the risk of fraud and mismanagement, both of which can severely impact cash flow and business reputation.

The Strategic Advisor

Beyond day-to-day management, bookkeepers can act as strategic advisors to the business. With their comprehensive understanding of the company’s finances, they can provide insights and recommendations that support strategic business decisions. Whether it’s expanding into new markets, investing in new technology, or hiring additional staff, a bookkeeper can assess the potential impacts on cash flow to ensure that the business is financially prepared for the future.

The Strategic Value of Expert Bookkeeping

The role of a bookkeeper extends far beyond simple record-keeping. They are integral to effective cash flow management, providing the expertise needed to maintain healthy cash reserves, ensure compliance, and support strategic decision-making.

For businesses looking to thrive in a competitive marketplace, partnering with a professional bookkeeper is not just a financial necessity but a strategic asset.

With the support of Molyet Bookkeeping & Accounting LLC, businesses can navigate their financial journey with confidence, ensuring that they have the resources to succeed and grow.

Contact Molyet Bookkeeping & Accounting LLC to unlock the full potential of professional small business accounting services.